Hello Everyone,

The Federal Reserve held interest rates steady on Wednesday as policymakers struggled to determine whether financial conditions may be tight enough already to control inflation, or whether an economy that continues to outperform expectations may need still more restraint.

The situation remained something of a riddle, with U.S. central bank officials willing to raise rates again if progress on inflation stalls, wary that a rise in market-based interest rates may begin to weigh on the economy in a significant way, and trying not to disrupt, any more than necessary, an ongoing dynamic of steady job and wage growth. Federal Reserve decided that the better course of action for now, given the uncertainties, was to maintain the Fed’s benchmark overnight interest rate in the current 5.25%-5.50% range, and see how job and price data evolve between now and the next policy meeting in December. Interest rates are now at their highest level in 22 years.

Roughly 20 months into the Fed’s aggressive tightening of monetary policy, it remained unclear whether overall financial conditions were yet restrictive enough to tame inflation that the feds still consider to be far above the central bank’s 2% target. The feds are not confident that they haven’t, they are not confident that they have reached that sufficiently restrictive plateau. Inflation has been coming down, but it’s still running well above their 2% target.

Annual inflation, based on the Fed’s preferred measure, was 3.4% in September for the third month in a row. Excluding volatile food and energy costs, it was 3.7%, little changed from August. The feds said that, while leaving the Fed’s benchmark rate unchanged for the second consecutive meeting, also took stock of what they called the “outsized” 4.9% annual pace of U.S. economic growth in the July-September period after a surge of consumer spending.

Economic activity expanded at a strong pace in the third quarter,” the U.S. central bank said in its statement after policymakers unanimously agreed to leave rates unchanged. The language marked an upgrade to the “solid pace” of activity the Fed saw as of its September meeting. Though markets think the Fed’s rate-hiking campaign may be finished, data pointing to a stronger-than-expected economy and labor market have kept the prospect of another hike on the table.

There’s no question the U.S. economic outlook has improved throughout 2023, but that doesn’t necessarily mean the economy is in the clear heading into 2024. The U.S. recorded 2.2% GDP growth in the first quarter of 2023 and 2.1% growth in the second quarter. As for its latest projections, the Fed expects the economy to roughly maintain that growth pace in the second half of 2023, forecasting full-year GDP growth of 2.1%. The Fed predicts GDP growth will slow to just 1.5% in 2024, a modest but positive pace.

The labor market also remains resilient heading into the end of the year. The unemployment rate has risen to just 3.8%, and the economy has averaged more than 250,000 jobs created per month over the past three months. The Federal Open Market Committee projects the U.S. unemployment rate will average a healthy 4.1% in 2024, still well below its long-term average of around 5.7%.

Unfortunately, some economists are skeptical that the U.S. can maintain economic growth with interest rates so high. The Conference Board predicts U.S. GDP growth of just 0.8% in 2024, including a “shallow recession” in the first half of the year. The nonprofit research group said wage growth is slowing, pandemic savings are declining, and U.S. household debt is spiking.

The COVID-19 pause on student loan payments ended in October, placing an additional financial burden on millions of Americans. As a result, The Conference Board projects real U.S. consumer spending will drop 1.1% in the first quarter of 2024 and decline 1% in the second quarter annually. The firm said softening consumption, coupled with rising interest rates, will also weigh on U.S. business investment in early 2024. The path is clearer for the Fed to pivot to rate cuts in mid-2024 with wage growth slowing, core inflation head(ing) lower and gasoline futures prices at year-to-date low(s).

Looking further into the future, the projection is the fed fund rate will fall to an average of 3.9% in 2025 and 2.9% in 2026. But investors shouldn’t rely too heavily on these extremely long-term projections given how much economic circumstances could change between now and then.

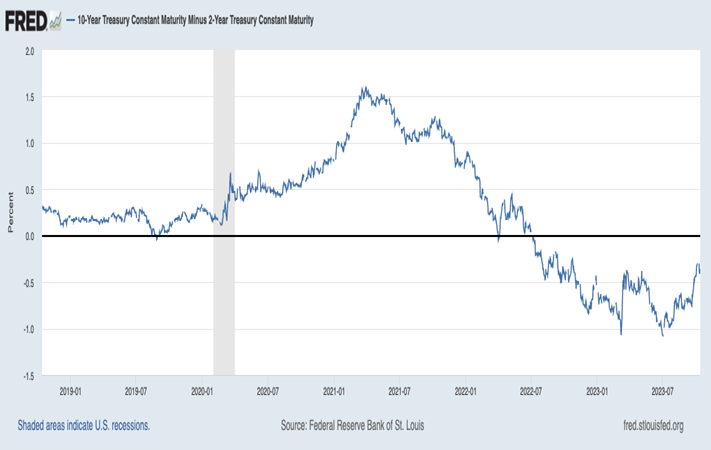

While there is no official government definition for an economic recession, economists typically consider at least two consecutive quarters of negative GDP growth to be a recession. The Fed is no longer forecasting a prolonged U.S. recession, and economists agree. The ratio of the 10-year yield to the 2-year yield curves in US treasury has been inverted since mid-2022, and an inverted yield curve has historically been a strong indicator a recession is likely.

The New York Fed’s recession probability model suggests a 56.12% chance of a U.S. recession by September 2024.

The positive performance of the stock market in 2023 may have lulled Americans into a false sense of economic security heading into 2024. There are elevated expectations for a bullish slowdown where the economy slows enough to bring down inflation but not enough to trigger a recession. Stocks are facing headwinds from higher interest rates and the uncertainty of how higher rates will affect economic growth and earnings. There is a need to continue monitoring the Labor Department’s monthly jobs reports, typically released on the first Friday of each month. As long as the economy continues adding jobs, GDP growth will unlikely drop into negative territory, experts say.

Castor demand in the US has trended down compared to levels in 2022 demand in 1st nine months of 2023 in the same timeframe. Contrary to the overall economic situation and the outlook of 2023, we have seen a trend down into the castor consumer sentiment in 2023. 2023 2nd half demand is projected to be around 15% less than 2022. Overall, the demand for the entire 2023 is expected to be around 10-12% less than 2022 demand.

Wishing all readers happy and healthy times ahead!

Ravi Shaheed, Vice President, Acme Hardesty Co.

Sources: Wells Fargo, Bank, Bloomberg Finance L.P., Federal Reserve System, U.S. Department of Labor, U.S. Department of Commerce, Institute for Supply Management, Conference Board