Dear ICOA members, Hello & Namaste,

As the year draws to a close between Diwali and Christmas, it’s time not only to take stock of the past year, but also to look ahead to the year to come.

Below you’ll find an overview of the EU economy, the EU chemical industry and its impact on the castor oil trade in Europe.

EU Economy

After a strong post-covid expansion in 2021 & 2022, the EU economy has slowed down this year. GDP slightly contracted in Q4 2022 and only made little progress in the first 3 quarters of 2023. High consumer prices, weaker external demand and tighter monetary policy weighed more than expected on economic activity.

Nevertheless, growth is expected to gradually recover from 2024 onwards. Inflation continues its downward trend from 6.5% in 2023 to a forecast of 3.5% in 2024.

Monetary tightening appears to have paid off. The European Central Bank last hiked its policy interest rates in September, by 25 bps.

As EU members phase out fiscal support measures, the EU general deficit is expected to slow down while public investment is set to increase.

The labor market remains strong with an unemployment rate at record low.

Increasing wages, continued employment growth and further slowing of inflation are set to increase the purchasing power of households in 2024 and 2025, enabling to boost consumption.

On the other hand, and in view of ongoing geopolitical tensions: war in Ukraine and conflict in the Middle East, risks to this better outlook remain high.

Source: European commission

EU Chemical Industry

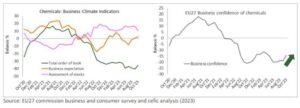

Despite lasting headwinds which continue to affect European business such high energy costs, high interest rates and inflation, EU chemical production has increased in October for the first time during the last 6 quarters but remains at low level (10% below 2019).

The latest economic survey shows an improvement in confidence in the EU 27 chemical industry.

Managers’ opinion on the current level of overall order books improved sharply.

Chemical production saw a slight increase of 0,5% in Q3-2023 compared to Q2-2023, while production was 6,6% lower compared to the previous year.

Nevertheless, the economic and political environment remains uncertain.

Therefore, it is too early to confirm whether this positive trend will last over time.

In 2022 chemical sales in Europe reached an all-time high. Due to high energy prices and increasing demand for chemicals, prices and sales increased sharply since early 2021.

The trend accelerated in the first half of 2022 due to the energy crisis and the war in Ukraine.

Since then, both prices & sales strongly decreased. EU chemicals decline in 2023 comes with a persistently difficult revenue situation for companies.

However, since August 2023, data show a slight upturn and chemicals sales grew by 1,8% compared to July 2023.

EU chemical production is expected to grow by less than 1% in 2023 and growth for 2024 is set to be below the structural growth of 3,5%.

Castor Oil in the EU

Given that our industry is strongly correlated with the economic situation, this drop-in activity in the European Union is reflected in castor oil import figures into Europe, down by around 10% compared to last year and by 17% compared to 2021.

The year was also marked by a change in the supply chain, with the predominance of containerized shipments to the detriment of bulk vessel shipments, given the price differential between both. We will need to monitor freight rate trends over the coming months and adapt logistics accordingly.

On the supply side, due to a goods owed surface of castor seeds during the summer, the upcoming harvest in India looks set to be equal to or even slightly larger than the last one. The weather will play its part and give us the final word. In terms of demand, hopefully the positive factors mentioned above will work in castor oil’s favor in 2024.

I would like to take this opportunity to wish you all a very happy festive season, and the very best for your families and loved ones.

Henri Lamy

Loriet Haëntjens