By: Denis Ginter, COFCO International

Dear Friends,

Castor planting in India was completed in October and the monsoon has meantime withdrawn from the main Indian Northwest castor belt (Gujarat and Rajasthan) leaving place for dry and warm weather conditions.

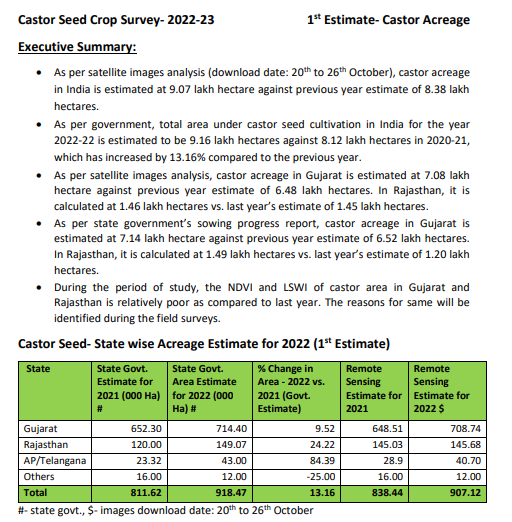

Early November we received the first estimates of the castor acreage crop survey for 2022/2023 from independent surveyor Agriwatch who put it at 9.07 lakhs (1 lakh=100k) hectares, against previous year estimate of 8.38 lakhs hectares resulting in an 8.19% increase from the previous year.

The State Government put the acreage estimate a little higher at 9.18 lakh hectare which would work back to an increase in size of 13.16% compared to their 2021 acreage number for the Indian castor crop.

During the past years the government acreage numbers proved to be rather accurate, but let’s wait for a few more months and see whether Agri-watch will adjust their findings upward or not for their 2nd estimate.

Source: Agriwatch (castor survey sponsored among others by ICOA)

Based on the average yields per hectare for each region we expect a 2023 castor crop between 1,9 million to 2 million tons of castor seed with an estimated carry over (of the 2022 crop) as per 1st January 2023 of 0,1 to 0,15 million tons.

In other words, a total crop ranging from 2 million to 2,15 million tons of seed, which can be qualified as a very good crop.

The 2022 global demand for castor oil and its derivatives has been slightly lower than 2021’s due to a strong reduction of demand from China and the geopolitical situation leading to uncertainty and high inflation.

This has alleviated the 2022 Supply/Demand (S/D) equilibrium which was considered a bit critical when the 2022 Indian crop was announced end February 2022, but S/D remains tight, until the 2023 new crop becomes widely available (as from 2nd half February 2023 onward).

For 2023, there are good grounds to believe that geopolitical precariousness should prevail hence that the overall demand for castor should show a similar pattern as in 2022.

All in all, based on the above we should have a comfortable 2023 supply/demand for castor.

Daily castor seed arrivals in Gujarat during the past two months have been on the very low size, averaging between 25,000 to 30,000 bags per day only.

As a result, thereof, many castor crushing plants have stopped running and are working on a per order/campaign basis due to the low seed availability.

One could expect this limited supply to continue up to January-February 2023.

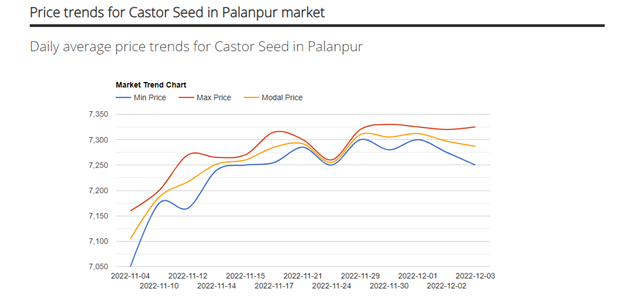

Due to the current low availability of castor seeds, prices in INR per Quintal (100Kg) have been ruling firm again since the month of November 2022

Source: commodityinsightsx.com

During the past months the conflict between Ukraine and Russia has lead to a strong inflation globally and to the devaluation of most currencies against the US Dollar, creating greater volatility than usual.

The USD/INR went from 74 INR at the beginning of the year 2022 up to 83 INR during September – October 2022 and at approx. 81.5 INR early December 2022.

Source: Xe.com

The EUR/USD went from 1.135 USD at the beginning of the year 2022 up to 0.96 USD during September and at approx. 1.05 USD early December 2022.

Source: Xe.com

Last but not least bulk tankers freight rates from India to Europe and the US have doubled since the beginning of the year and may continue to rule firm.

The port of Kandla (the bulk castor oil export hub from India) has been experiencing heavy congestion during the past 2 months, with waiting time up to almost 14 days! This is creating big and painful demurrage bills for charterers.

The container freight market from Asia to Europe and the US has, in contradiction with the bulk tanker market, reduced strongly compared to the peaks of Q1/2022.

Wishing you and your loved ones a nice Christmas break ahead and let us hope we will get back to a peaceful and less uncertain world in 2023!

Denis Ginter

COFCO International