US Regional Economy View

Hello Everyone,

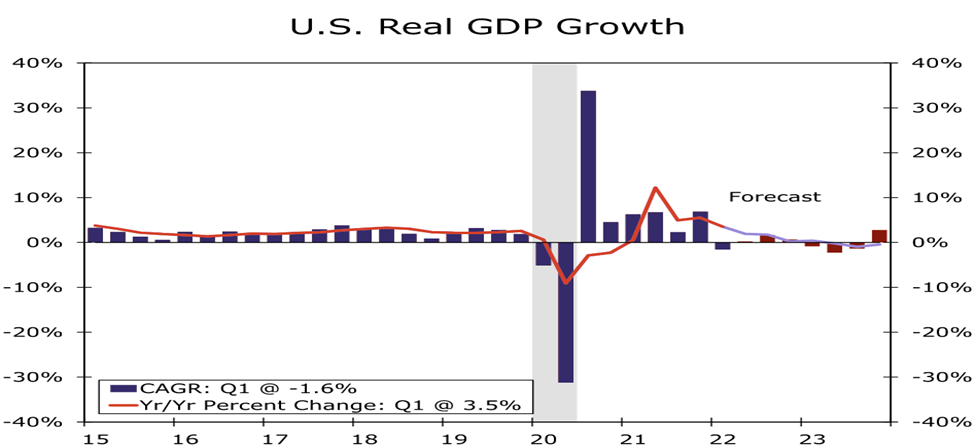

Over the last 30 days, signals of a slowdown in the U.S. economy have surfaced. Weaker real spending suggests that the spending power of U.S. consumers is coming off, housing activity is slowing under the pressure of higher interest rates, and business investment is sliding amid growing slowdown fears.

Economists estimate U.S. GDP barely expanded in the second quarter, advancing at just a 0.2% annualized rate. At that pace, it would not take much in the way of slightly weaker-than-expected spending and investment for GDP to register a second consecutive negative print, which has raised concerns the economy is already in a recession. However, it is not believed that economic activity is retrenching just yet particularly as hiring through June remained strong.

Strength in core inflation, however, remains widespread and the retreat toward 2% remains slow and distant. Inflation touched a 40 year high 9.1% in June and the expectation on core CPI when measured on a year-ago basis is to reach a fresh cycle high in Q3. Core PCE is still on track to be more than double the Fed’s target year-over-year in Q4, with the annualized rate of price growth not much better at a 3-3/4% pace.

The blistering pace of core inflation in recent months offers monetary policymakers very little reassurance that inflation is on a sustainable downward path at present. The FOMC is likely to continue to hike aggressively at upcoming meetings, starting with a 100-bps hike at the July 27 meeting. That will put the policy rate just above neutral, and it is expected that the Fed will push into restrictive territory with the fed funds rate reaching a range of 4.0-4.25% by the end of the year.

Slower growth prospects in addition to a few rare positive supply developments have pushed commodity prices sharply lower in recent weeks. Lower costs might pare back expectations for headline inflation later this year as a result. Recent data suggests the slump is likely to occur somewhat in the first quarter of 2023. The downturn should help alleviate inflation pressures enough to where the Fed begins easing policy in the second Q/second half of 2023.

The resiliency of the U.S. consumer in the face of torrid inflation is starting to falter. Real consumer spending fell in May, while previous months’ outlays were revised lower. The good news is that household finances do not look to be deteriorating as quickly as earlier data suggested. The saving rate is now reported to have remained above 5% in recent months, and the rate at which consumers are tapping credit cards has slowed from its recent breakneck pace. The bad news, however, is that the reluctance to lean on savings and credit when real disposable income is barely growing puts the near-term spending outlook on more precarious footing.

Housing activity also continues to pull back under the weight of higher mortgage rates and stretched household budgets. May’s jump in new home sales looks like a last attempt from buyers racing to lock in borrowing rates. But existing home sales, which make up the vast majority of purchases, slid further, and new construction is slowing as builder sentiment deteriorates. It is expected to see residential investment contract at a double-digit annualized pace in the second quarter and forecast further declines in subsequent quarters as higher interest rates affect spending on homes.

Business investment is holding up better amid still sizeable backlogs. However, new orders have slowed, and declining outlays for nonresidential construction point to structures investment shrinking in the second quarter. After businesses’ needs to replenish stocks led to the largest inventory build on record the past two quarters, inventory growth is also starting to moderate and looks poised to carve off more than a percentage point from topline GDP growth in Q2.

| Source: U.S. Department of Labor and Wells Fargo |

Labor market data has signaled that a broad retrenchment in activity has yet to materialize. Hiring once again exceeded expectations in June, with employers adding 372K new jobs. Meanwhile, job openings, initial jobless claims and consumers’ views of the labor market remain at levels consistent with one of the strongest labor markets in decades. However, each of these measures weakened over the past month, and, alongside a net downward revision to payrolls for April and May, point toward the labor market starting to cool.

In another sign that the labor market has reached a turning point, wage growth has eased since late last year. Average hourly earnings advanced 0.3% in June, slowing the three-month annualized pace to 4.2% compared to more than 6% as recently as December. The moderation is likely to reduce fears among Fed officials of a wage-price spiral taking hold and usher in optimism that the inflationary impulse from the tight labor market is at least no longer getting worse. But even at the recent clip, wages continue to advance at a pace inconsistent with the Fed’s inflation target.

In addition to a forecast of recession in the United States, slower global growth forecast in 2023 stems from mild recessions that are also expected in the United Kingdom, Brazil and Mexico. It is expected that economic growth in Canada will come to a standstill next year, while the Eurozone, China and India are also likely to see noticeably softer growth than previously forecast. Due to above reasons economists forecast dollar strength over the remainder of 2022 and into 2023. However, given a shorter and sharper Fed rate hike cycle, along with U.S. recession, it is believed the U.S. dollar could peak by early next year, and expect the greenback to soften against G10 and emerging market currencies through much of 2023. Castor demand in the US has remained on similar levels as 2021 demand in 1st half of 2022 in the same timeframe.

Based upon the overall economy situation and the outlook of slowdown being projected, we are starting to see a similar trend filtering down into the castor consumer sentiment in Q3 2022. Q3 demand is projected to be around 10% less than Q3 2021 and 15% less demand is projected for the 4th Q of 2022 compared to Q4 2021. Overall, the demand for the entire 2022 is expected to be around 10% less than 2021 demand.

Wishing all readers happy and healthy times ahead!

Ravi Shaheed, Vice President, Acme Hardesty Co.

Source: Wells Fargo, Bloomberg Finance L.P., Federal Reserve System, U.S. Department of Labor, U.S. Department of Commerce, Institute for Supply Management, Conference Board